Safeguard Your Home and Loved Ones With Affordable Home Insurance Coverage Program

Relevance of Affordable Home Insurance Coverage

Securing affordable home insurance policy is crucial for protecting one's residential property and financial well-being. Home insurance gives security versus numerous risks such as fire, burglary, natural catastrophes, and personal liability. By having a detailed insurance policy strategy in location, home owners can relax assured that their most significant financial investment is secured in case of unforeseen scenarios.

Economical home insurance not just supplies monetary security yet also supplies assurance (San Diego Home Insurance). Despite rising building worths and building expenses, having an affordable insurance coverage makes certain that property owners can easily rebuild or fix their homes without dealing with considerable monetary worries

In addition, budget friendly home insurance policy can additionally cover individual belongings within the home, providing repayment for items damaged or swiped. This coverage expands beyond the physical framework of the residence, safeguarding the contents that make a residence a home.

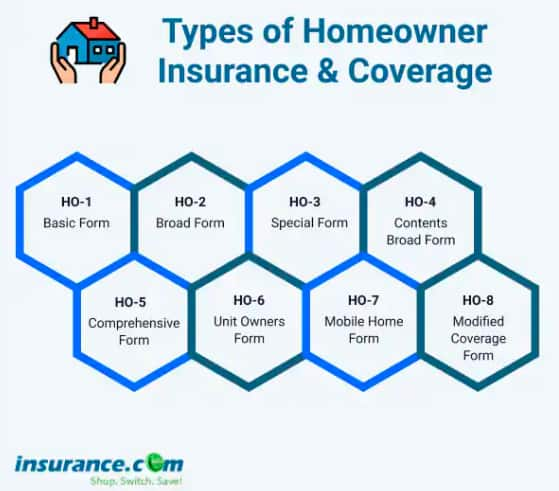

Protection Options and Boundaries

When it involves coverage limitations, it's important to recognize the optimum amount your plan will pay for each kind of protection. These restrictions can differ relying on the policy and insurer, so it's important to evaluate them meticulously to guarantee you have ample security for your home and assets. By understanding the insurance coverage options and limitations of your home insurance plan, you can make informed decisions to guard your home and loved ones successfully.

Variables Affecting Insurance Policy Expenses

A number of variables considerably influence the expenses of home insurance coverage. The location of your home plays a crucial duty in identifying the insurance premium. Houses in locations susceptible to natural catastrophes or with high crime rates generally have greater insurance coverage costs because of increased dangers. The age and condition of your home are also variables that insurance companies think about. Older homes or buildings in poor problem might be extra pricey to insure as they are extra prone to damage.

In addition, the kind of top article coverage you pick directly influences the cost of your insurance coverage. Choosing added coverage choices such as flooding insurance or quake insurance coverage will certainly enhance your costs. In a similar way, picking greater coverage restrictions will lead to higher costs. Your insurance deductible quantity can likewise influence your insurance policy prices. A greater deductible usually means lower premiums, but you will certainly have to pay more expense in the event of a case.

Furthermore, your credit history, claims background, and the insurance policy firm you pick can all affect the rate of your home insurance coverage policy. By thinking about these variables, you can make informed decisions to help handle your insurance coverage sets you back effectively.

Contrasting Quotes and Companies

In enhancement to comparing quotes, it is important to evaluate the reputation and monetary security of the insurance policy providers. Seek client evaluations, ratings from independent companies, and any kind of history of grievances or regulatory activities. A dependable insurance coverage provider must have an excellent track record of promptly refining insurance claims and offering exceptional customer care.

Furthermore, consider the certain insurance coverage attributes offered by each service provider. Some insurance firms may provide fringe benefits such as identification theft protection, devices breakdown coverage, or protection for high-value items. By carefully check my blog comparing service providers and quotes, you can make an informed choice and pick the home insurance coverage strategy that finest satisfies your requirements.

Tips for Minimizing Home Insurance Coverage

After completely contrasting providers and quotes to discover the most suitable protection for your needs and budget, it is prudent to explore reliable methods for saving on home insurance coverage. Lots of insurance business use discount rates if you acquire multiple policies from them, such as combining your home and vehicle insurance policy. Regularly evaluating and upgrading your policy to reflect any type of changes in your home or scenarios can ensure you are not paying for insurance coverage you no longer demand, aiding you save cash on your home insurance premiums.

Verdict

In verdict, guarding your home and loved ones with budget friendly home insurance is important. Applying suggestions for saving on home insurance coverage can additionally assist you secure the required protection for your home without more info here breaking the financial institution.

By deciphering the ins and outs of home insurance policy strategies and checking out functional methods for protecting economical coverage, you can guarantee that your home and loved ones are well-protected.

Home insurance coverage plans typically use several insurance coverage alternatives to protect your home and items - San Diego Home Insurance. By comprehending the protection choices and restrictions of your home insurance plan, you can make educated decisions to guard your home and liked ones efficiently

Regularly examining and updating your policy to mirror any adjustments in your home or scenarios can guarantee you are not paying for coverage you no longer demand, aiding you save cash on your home insurance policy premiums.

In verdict, securing your home and enjoyed ones with inexpensive home insurance coverage is crucial.